Navigating official paperwork in a new country can be a daunting task. In Italy, you might encounter the term “marca da bollo” and be unsure what it signifies. Fear not! This guide will equip you with all the essential information about this crucial revenue stamp.

The Marca da Bollo Explained

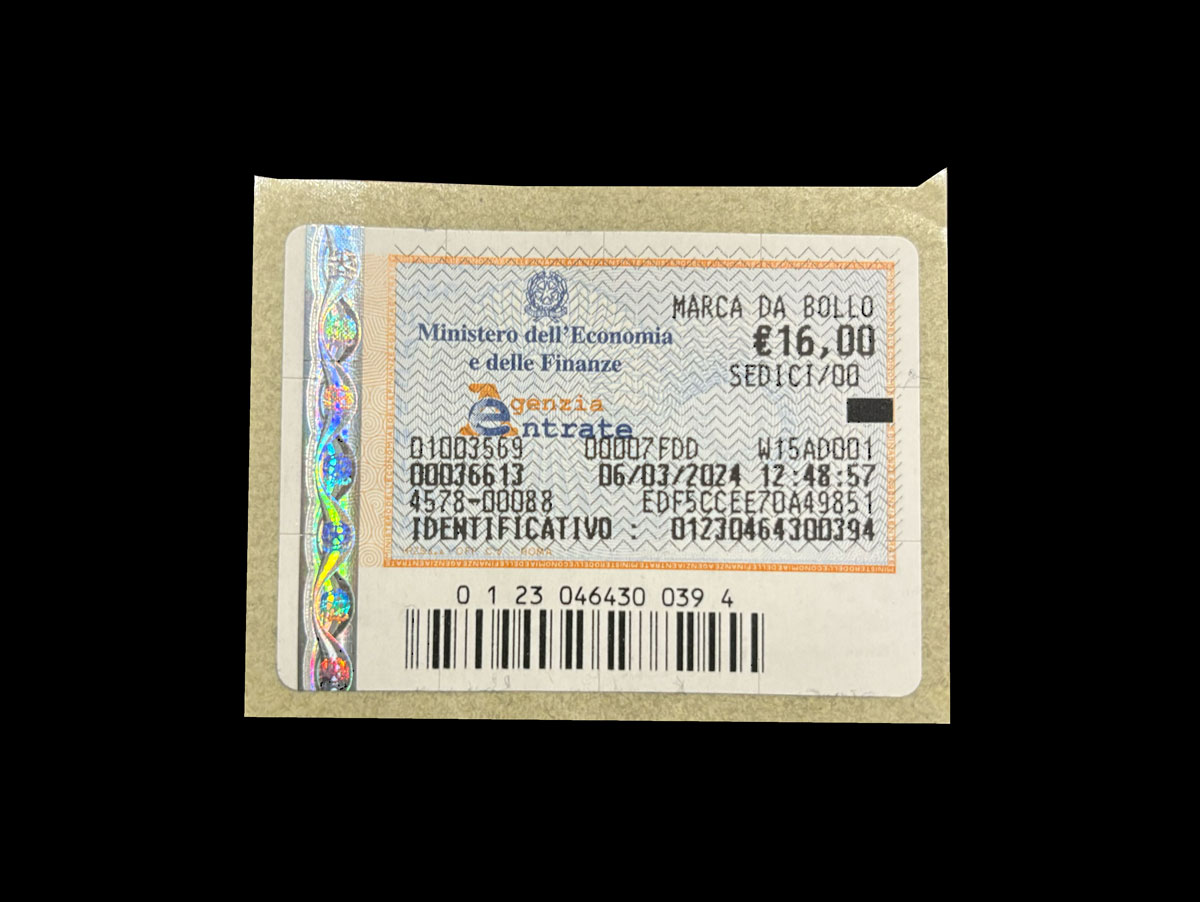

The marca da bollo, literally translating to “stamp duty,” plays a dual role in the Italian system. Firstly, it serves as proof that a tax has been paid on a specific document, contributing to the government’s revenue. Secondly, it acts as a validation tool. Certain documents require a marca da bollo to be considered legally recognized by the authorities. Without this stamp, your document could be deemed incomplete or even rejected. Imagine it as a special sticker that grants official status to specific paperwork. There are two main ways to obtain a marca da bollo: the traditional physical sticker and the more modern electronic version.

Acquiring Your Marca da Bollo

The Physical Marca da Bollo:

This method remains widely available and familiar to most Italians. To get a physical marca da bollo, keep an eye out for “tabaccherie” – tobacco shops scattered throughout Italy that also sell various official items. Look for the distinctive “T” sign outside. Once inside, inform the shopkeeper of the amount you need, which is typically specified on the document you’re filing. Pay (cash is usually accepted) and the shopkeeper will print out your marca da bollo for you.

The Electronic Marca da Bollo (e-bollo):

This option requires internet access and offers a more convenient approach. To obtain an e-bollo, visit the website of the Agenzia delle Entrate (Italian Revenue Agency). They offer an online service called “@e.bollo” specifically designed for purchasing electronic marca da bollo. The service operates through authorized payment providers, so you’ll need to choose one compatible with @e.bollo. After selecting a provider, make the payment electronically. The e-bollo will then be electronically linked to your document.

It’s important to note that e-bollo isn’t universally accepted yet. Whether an entity accepts e-bollo depends on their participation in the “Sistema dei pagamenti elettronici – pagoPA” system. The cost for the electronic marca da bollo is typically a flat €16, regardless of the document type.

When is a Marca da Bollo Required?

Not all documents require a marca da bollo. Here are some common situations where you’ll likely need one:

- Public Administration Documents: Permits, licenses, and applications submitted to government agencies often necessitate a marca da bollo.

- Company Documents: Documents like articles of association, company registration papers, and certain filings might require a marca da bollo.

- Notary Documents: Official documents like deeds, wills, and power of attorney documents prepared by a notary public often require a marca da bollo.

- Passports: During the application process for a new passport or renewals, a marca da bollo might be necessary.

- Invoices and Receipts: For invoices and receipts exceeding a specific amount (currently €77.47), a marca da bollo is usually required.

The Cost of the Marca da Bollo

In most cases, there are no additional fees beyond the face value of the marca da bollo itself, whether you purchase a physical or electronic one. Here’s a breakdown:

Physical Marca da Bollo:

You’ll typically pay the exact amount indicated for the document (e.g., €2 for invoices exceeding €77.47). The shop might have a small service charge, but it’s usually minimal (a few cents) to cover the cost of operating the printing machine. It’s best to ask the shopkeeper beforehand if there’s any additional service fee.

Electronic Marca da Bollo (e-bollo):

You’ll pay a flat fee of €16, regardless of the document type. There shouldn’t be any additional fees associated with the electronic purchase itself. However, the chosen payment provider you use with @e.bollo might have its own processing fees. These fees, if any, would be minimal and transparent during the checkout process.

Avoiding Penalties

Failing to affix a marca da bollo when required can lead to penalties. The penalty amount can be up to 30% of the tax you owe, with a minimum of €30. It’s always advisable to double-check if a document requires a marca da bollo to avoid any potential complications.

Over to You

When unsure about the required amount for a physical marca da bollo, consult the document itself or inquire at a local public office. Remember to keep the receipt for your marca da bollo purchase, as it might be needed for reference in the future. If you’re dealing with a complex document or unsure about the marca da bollo requirement, consider seeking assistance from a commercialista (Italian tax advisor) or a CAF (Centro di Assistenza Fiscale – Tax Assistance Center).