Waste management only managed through the government including Lecce, Italy, where the Tributo per lo Smaltimento dei Rifiuti (TARI) ensures that all citizens pay for to the proper disposal of waste through annual taxation. Whether you’re a homeowner, business owner, or tenant, understanding how to set up garbage service through TARI is essential. In this detailed guide, we’ll walk you through the process step by step, ensuring that you can navigate waste management in Lecce with ease.

Registering TARI In Lecce

Every citizen who owns or occupies premises capable of producing urban waste is obligated to participate in differentiated waste collection and contribute to the cost of waste collection, disposal services, and urban hygiene services, such as street cleaning and garden maintenance. To fulfill this duty, you must inform the Municipality of Lecce about the occupancy of your premises. This involves completing and submitting a declaration form available on the official municipal website or directly at the town hall.

Providing Essential Information for TARI Assessment

When submitting your declaration to the Office of Taxes, it’s crucial to include essential details about your property, such as its cadastral data and relevant factors for determining the TARI bill. For residential properties, this includes the surface area and the number of actual occupants. For non-residential properties, it involves indicating the surface area and the type of activity conducted on the premises

Submission and Communication Channels

You can submit your declaration to the Office of Taxes (Ufficio Tributi ) either in person at Piazza Partigiani 40 or through various communication channels provided by the Municipality of Lecce. These include email addresses listed on the declaration form, sending via regular mail to [email protected] or certified email (PEC) to [email protected], or delivering it directly to the (l’ufficio protocollo) protocol office at Via Rubichi.

Who is responsible for paying TARI

TARI typically paid by the occupant of the property in the case of long term rentals. This can be either the owner occupant, or a long term tenant. If the property is rented out for less than six months (known as short-term occupancy), the owner, not the tenant, is responsible for paying the fee. The fee is calculated based on either the size of the property or the amount of waste generated.

Bringing Non-Compliant Properties into Compliance

For properties that have not been contributing to TARI, there is an opportunity to rectify the situation by submitting the declaration form to the Office of Taxes or the protocol office. You should indicate the start date of occupancy to initiate the regularization process. The Municipality will then conduct an assessment and may request payment for outstanding taxes, up to a maximum of five years, along with interest and penalties.

Accessing Waste Collection Materials

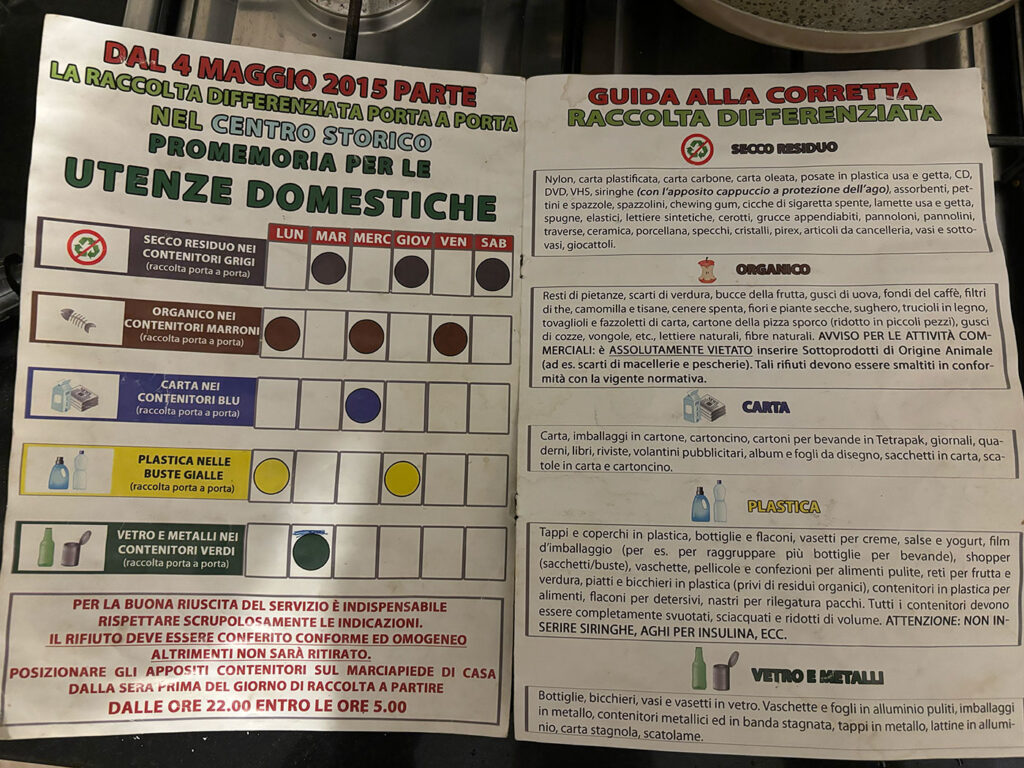

Upon submitting the self-declaration form to the Municipality, which includes your protocol number and stamp, you can collect a waste separation kit from the Monteco front office on Via Diaz in Lecce. Monteco is the Garbage company. This kit typically includes bins for organic waste, paper, residual dry waste, as well as bags for organic and plastic waste and also the separation instructions, and pick up calendar for your districdt.

If your self-declaration is submitted via PEC, you shold have the protocal number and stamp with in a few days. However, if submitted via email, it can take months. In that case, you best best is to to forward the delcaration email you sent to the commune to Monteco and aks them to pre-register you in the system before you go and pick up the bins. Their email is [email protected]

Special Considerations

ARI Social for Low-Income Families To support low-income families, the Municipality of Lecce has introduced TARI Sociale. This program offers total exemption for families with an ISEE (Equivalent Economic Situation Indicator) below 6,000 euros and for individuals permanently assisted by the Municipality. Additionally, there is a 50% reduction in the variable part of the tax for families with an ISEE up to 9,000 euros and those with an ISEE up to 14,000 euros, provided there is a person with severe disabilities (article 33) entitled to care allowance. Moreover, there is a 20% reduction in the variable part for residential properties rented to university students.

Conclusion

setting up garbage service in Lecce through TARI involves fulfilling your civic duty, providing essential information, submitting declarations, accessing waste collection materials, and understanding special considerations such as TARI Sociale. By following these steps and contributing to proper waste management, residents and businesses can play a vital role in maintaining cleanliness, hygiene, and sustainability in Lecce. Additionally, taking advantage of programs like TARI Sociale ensures that waste management remains inclusive and accessible to all members of the community. So, if you reside in Lecce and have yet to pay TARI, now is the time to do so, ensuring a cleaner and greener future for our city.